A hybrid annuity for long term care hybrid annuity accounts are part long term care policy and part annuity.

Hybrid long term care annuity.

This can provide an annuitant with tremendous leverage of their premium dollars.

Hybrid long term care annuities provide long term care insurance if you need care and cash value to your estate if care is not needed.

These long term care combination policies avoid the high cost of ongoing annual long term care insurance premiums associated with traditional ltc insurance policies.

Hybrid long term care insurance policies typically are funded with a single upfront premium and offer the benefits associated with the life annuity policy base together with additional benefits of long term care coverage.

These hybrid policies work variously but the type that has gotten the most attention is a long term care annuity.

They provide leveraged payouts for long term care expenses like traditional ltci policies but also offer the advantages of a fixed annuity policy.

These hybrid long term care products like traditional deferred annuities provide future payments based on an initial lump sum investment.

Pay over 5 or 10 years.

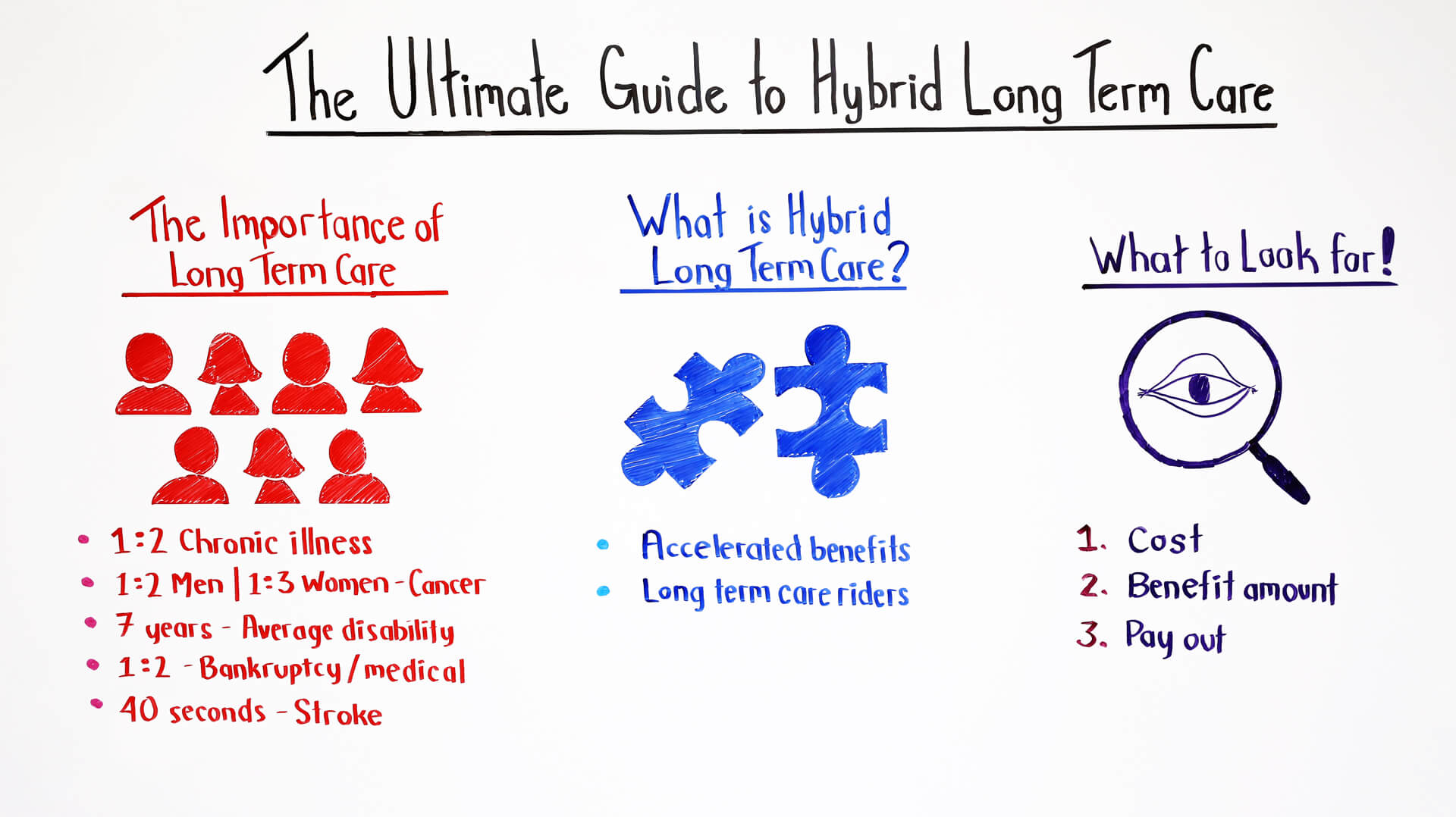

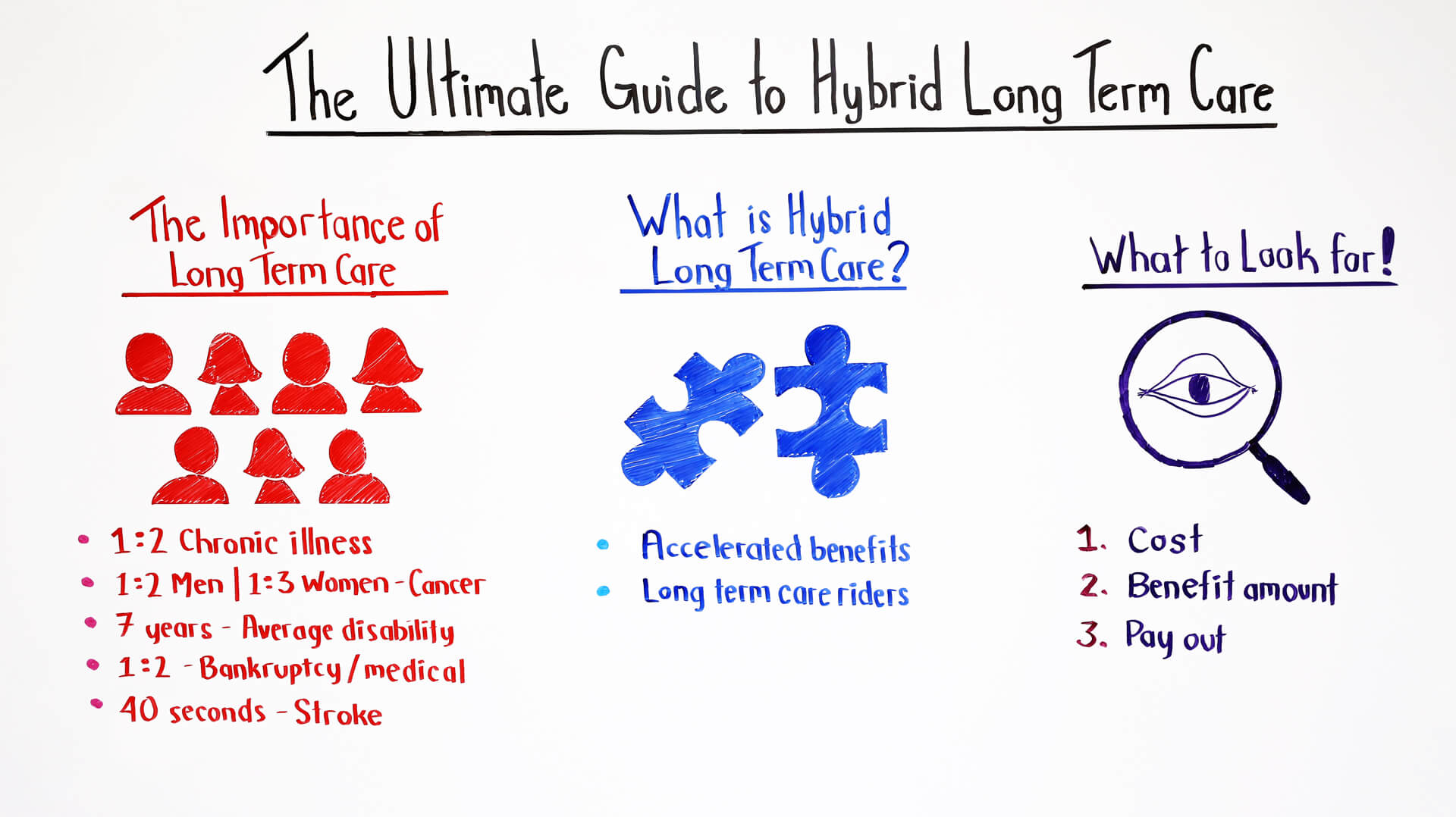

Long term care annuities and life insurance with long term care benefits are growing in popularity as viable alternatives to long term care insurance.

Beginning in 2010 the irs will let those who hold one of these deferred annuities.

Long term care annuities are considered to be a type of asset based long term care or otherwise referred to a hybrid policy.

A person can buy a hybrid policy by paying a one time lump sum premium.

Long term care annuity benefits are a pool of money.

We offer hybrid long term care annuity accounts from several insurance carriers.